Update: now (march 28th) Im regretting keeping this as a draft for so long! a catalyst is on the horizon! damn me for being too busy to write!

Disclaimer: I have a position here, since the beginning of the month.

As you may have already guessed, I am quite the vulture and quite the contrarian.

China is uninvestable, tech is a bloodbath, finance is dead…. In such an environment, of course, I will start looking for bargains in China, the tech sector, and the banking sector (Though, I have a cautionary tale on that coming soon…)

When it comes to Alibaba, everything bad I hear is mostly related again to macro, not business fundamentals, it is all doom and gloom regarding China, it is about to explode, most likely! 🙂

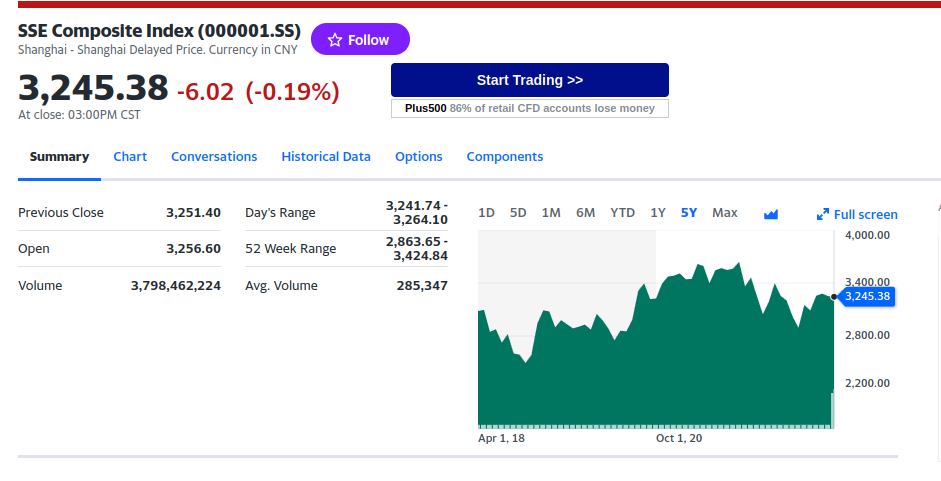

However, the one thing to notice in this rush for the exits is the chinese seem impervious to it, only foreigners seem to be losing their shit!

Valuation

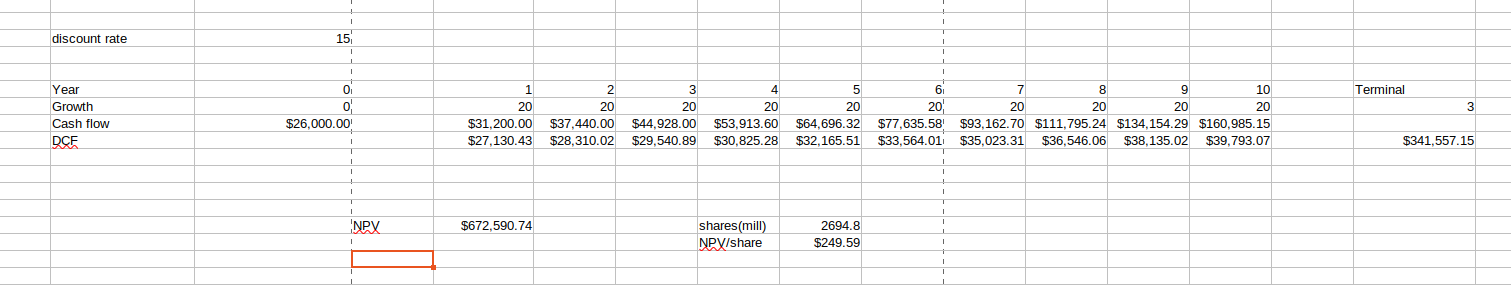

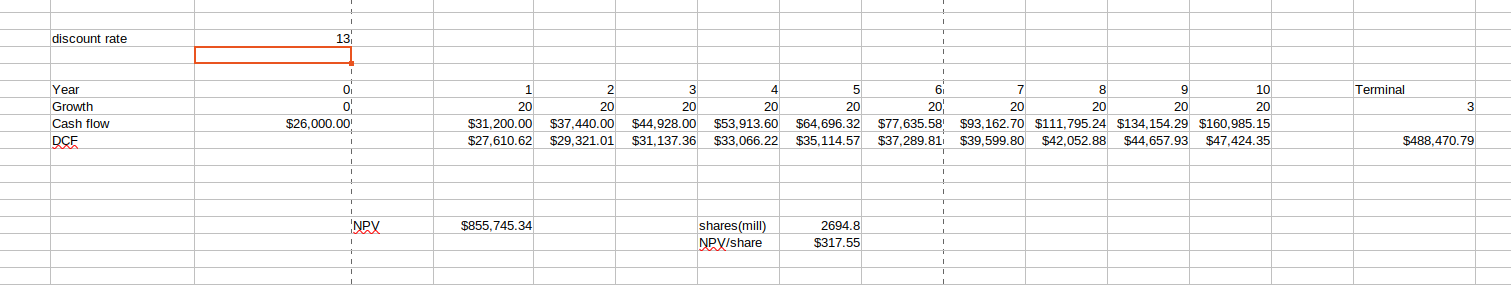

The company is still putting out absurd revenue growth in this environment. Let’s do some hypotheticals assuming a return to a 20% net margin roughly. (Numbers in USD, millions)

What do you know.

Conclusion

Alibaba is worth $250/share being very cautious, and most likely over $300.

BUY. Hand over fist if you like good businesses at absurd prices.

Leave a Reply